International Student Services

New International Student Checklist

- Apply to Oglethorpe.

- Submit an I-20 Request Form.

- Pay the I-901 SEVIS Fee.

- Apply for an F-1 Visa and schedule your visa interview at a US embassy.

- Make a virtual appointment with an OU International Student Advisor.

- Complete the Petrel checklist to notify us when you get your visa and confirm your travel details.

- Attend International Student Check-In and New Student Orientation!

Download the F-1 International Student Checklist

Current International Student FAQs

- Passport: Your passport is your primary identity document that must remain valid for the duration of your F-1 program.

- I-20: Your I‐20 form is a contract between you, Oglethorpe, and the U.S. that also must not expire before you complete your program of study. Your I-20 documents your personal, financial, and academic program of study details. The form I-20 is required to apply for the F-1 visa and benefits like a GA driver’s license or social security number, if eligible.

- Visa Stamp: Your visa is your ticket to request entry to the U.S. It is okay if your F-1 visa in your passport to expires while you are in the U.S. as the visa must only be valid when crossing the border to enter into the U.S. Visas are only granted/renewed outside of the U.S.

- I-94 arrival/departure record: Form I-94 is the DHS Arrival/Departure Record issued to aliens who are admitted to the U.S., who are adjusting status while in the U.S., extending their stay, among other things. This will determine your duration of status.

International students who come to the United States must follow a specific set of rules, depending on your student type and education level. UF‐1 students must abide by immigration laws to maintain visa status and remain eligible for benefits. No benefits are available to students in violation of F‐1 status. Use the resources below to learn how to become an F or M international student and maintain your student status.

- Maintain a valid passport and valid I-20 Rform.

- Enroll in a full course of study (minimum 12 credit hours).Attend class sessions per the attendance policy.

- Make ‘normal’ academic progress in your studies.

- Engage in authorized employment only.

- Depart the U.S. within the grace period at the end of your program of study.

- Update your International Student Advisors of any changes to your address, contact information, major, need for an extension of program, need for travel endorsement, etc. via the International Student Request Form.

- Obey all state and federal laws.

The Student Exchange Visitor Program Study in the States website is a great resource that outlines many topics related to maintaining visa status, applying for F-1 benefits, and other relevant topics for F-1 student visa holders.

Because the purpose of the F-1 visa is to facilitate full-time study toward completion of an academic program of study, immigration places limitations on the work/employment benefits available to F-1 student visa holders. The limitations are associated with the amount and type of work the F-1 student is eligible for and the conditions they must meet to be authorized for additional work benefits.

On-Campus Work:

- Defined as work for Oglethorpe as a temporary employee or employment with an on-campus entity that has a contract with Oglethorpe to provide services to students (such as Athletics, Facilities, Library, Campus Store, Dining Services, etc).

- The evidence of authorization for on-campus work is the form I-20.

- F-1 students are eligible to begin on-campus work once they have completed a “check-in” with the International Student Advisor (ISA) in Global Education.

- On-campus work may be no more than 20 hours per week during the fall and spring semesters when students are required to be enrolled full-time (FT) in classes.

- Immigration laws allow on-campus work more than 20 hours when they have earned a vacation semester or in between required semesters.

Off-Campus Work:

- ANY employment outside of Oglethorpe (paid or unpaid).

- Eligible only after F-1 has enrolled full-time in an academic year (fall and spring semester).

- Position MUST be directly related to major(s) and may require both ISA and USCIS review.

- Cannot begin work until authorization is granted (in the form of an I-20 and/or an I-766 work permit (EAD) issued by USCIS).

- Off-campus work benefits for F-1 students include Curricular Practical Training (CPT), Optional Practical Training (OPT), Severe Economic Hardship (SEH) or Special Student Relief (SSR)

- Off‐campus employment workshops are offered regularly or talk with an International Student Advisor.

For additional details request the F-1 Employment Benefits handout from the ISA

- GA Department of Driver Services (DDS) requires a Social Security Number (SSN) or denial letter issued from the Social Security Administration Office.

- Those not eligible for SSN can request a SSA denial letter.

- Read GA DDS website and driving regulations to be prepared.

- Fully understand the responsibilities and risks of driving.

- Must register (pay taxes & tag fees) on your car within 30 days of purchase.

- Fully understand the responsibilities and risks of driving.

- Must register (pay taxes & tag fees) on your car within 30 days of purchase.

- Can only register a car in GA with a GA Driver’s License and with proof of car insurance

Re-entering the U.S. as an F-1 student after international travel requires:

- Unexpired passport (6+ months validity).

- Visa stamp (You can renew before return to the U.S. at embassy abroad).

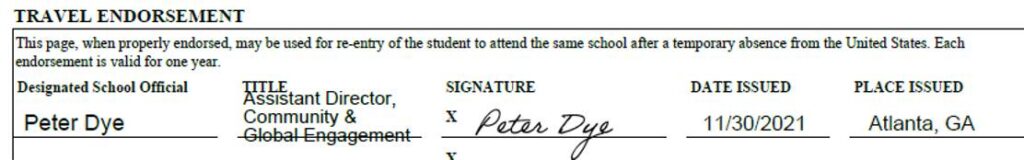

- I-20 travel signature/endorsement (Request a travel signature via the International Student Request Form).

- Connect with an ISA before any international travel- but a signature is valid for 12 months while pursuing full-time study and 6 months when on authorized post-completion OPT.

- Travel Tips

- Make/keep electronic and print copies of all your visa status documents:

- I‐20

- I‐94 arrival/departure information

- F‐1 visa stamp (check the expiration date of your visa)

- Passport (photo & expiry pages)

- Don’t carry originals around with you daily (keep originals in a safe place; copies elsewhere)

- Be prepared for travel delays and have a backup plan

- Know that visa applications/renewal can take time

- The Internal Revenue Service (IRS) is the federal agency responsible for taxation

- The U.S. tax year starts January 1 and ends December 31

- All F-1 students must complete a Tax Form 8843 each tax year physically present in the U.S.

- Filing a tax return is the IRS process reconcile the tax withheld to the amount IRS says an individual is liable to pay in that tax year

- Individuals who earn income in the US will have a tax liability

- Some types of investments and scholarships may also be taxable by the IRS

- F-1 students receiving income or scholarship or treaty benefits must file a tax return to the IRS the following tax year by the deadline (Filing an international student tax return – U.S. tax season survival guide for F-1 visa students)

- The tax filing deadline is usually mid-April/April 15 each year.

- Global Education sends regular communication by email to students once they are admitted and pay their enrollment deposit.

- These emails include resources to assist students to apply for their visa, personal preparations, making decisions about healthcare and health insurance, and understanding when to arrive to campus for new international student onboarding.

- Students will also connect to each other and international student leaders in the Pre-Arrival course that all newly admitted students have access to a few months before classes begin and throughout their studies at Oglethorpe.

- Finally, Oglethorpe offers programs that help all students prepare for life as a Petrel and New Student Orientation and Welcome Week to support greater awareness of campus resources and to build connections to peers.

- Enrollment Services: For questions about registration, records, financial aid, billing, and payments

- Campus Life: For information about dining, campus clubs and organizations, sports, arts, and the city of Atlanta

- Library: Visit the physical or virtual library to find books and articles, and get help from librarians on citations and research

- Career Development: For help finding jobs and internships, networking, or writing a resume or cover letter

- Student Success: For tutoring services, supplemental instruction, accessibility services, academic coaching, a reduced-distraction testing environment, and writing support

- Global Education: For information about international student services and study abroad

- Community and Global Engagement Bookings Page: To book an appointment with Peter and Marisa when you have questions about international student services and advising

- International Student Check-In and Request Form: Required in the beginning of every semester to check in with the ISA.

- International Student Check-In and Request Form – Tutorial: An easy tutorial and guide for what to do when completing your form.

- OUGlobal: Follow us on Instagram!

- OU Counseling Center: For mental health, wellness, and consultation services to support the campus community and current students’ pursuit of their academic and personal goals.

- OU Student Wellness: Student resources for health and wellness.

Academic Expectations

- Every country and culture has different ideas about what makes a good student. In some countries, a good student is a person who doesn’t ask a lot of questions. In other countries, a good student is a person who talks a lot in class. Let’s look at some of the differences you might find between being a student in your country and being a student in the United States.

- Interactive Classrooms:

- In the US most classrooms, even college classrooms, are very interactive, particularly when compared to some countries.

- Students are expected to ask questions, join discussions, and work in small groups on projects or exercises.

- In general, students who ask questions are viewed positively because asking questions demonstrates that they want to understand and learn.

Classroom Environment

- American culture is casual compared to some other countries. Teachers might wear blue jeans and might drink coffee during class.

- Some faculty and staff on campus may be okay with you addressing them by their first names. For example, you are welcome to refer to your International Student Advisors by their first names (Marisa and Peter). We want you to feel comfortable and relaxed around us, so don’t feel that you need to be overly formal.

- However, with your professors, you do want to show respect, and it is recommended to always begin referring to them with Dr./Professor followed by their last name or surname. For example, Dr. Alford, Dr. Shrikhande, Dr. Winter-Parks, etc. Some may give you permission to use their first names, but it is always best to start with the most respectful address option.

Plagiarism

- Plagiarism is using another person’s writing and pretending it is your writing.

- We have lots of rules about how to show your readers which words and ideas in your compositions come from another person. You will learn all about this in your courses and through campus support like the library. If you’re ever not sure how to cite a source or if something might be plagiarism, ask one of our wonderful librarians for help!

- Some countries don’t care too much about plagiarism, but in the US it is a big deal

- People get thrown out of university or can lose their jobs over plagiarism.